Our Services

Unbiased Fee Based Consulting looking at Individuals, Families, Business Owners and Employees of Enterprises.

Consulting Services

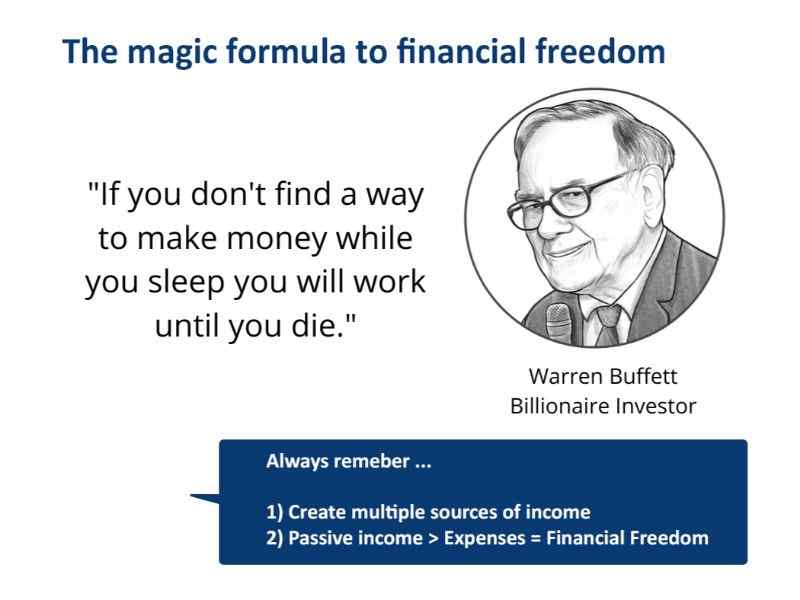

I. Building your future outlay (Risk Management, Goal based outlay allocation & Restructuring, Retirement Planning, Tax Planning, Budgeting & Cash flow planning, Debt Management & Goal Realisation)

ii Reviewing your Outlay and Structure

iii Re balancing your existing structure

Execution & Implementation of suggested outlay (access to wide range of products available in the market)

Portfolio Maintenance Services

i. Periodic reporting of performance

ii. Key Result Areas and Key Performance Indicators

Estate, Inheritance & Succession design and drafting

Tax Filing & Loan Arrangement

Family Office

- Futuristic Goal and Aspiration Consulting of the Family

- Goal Based structuring , Outlay and restructuring

- Understanding Family Governance/Objectives

- Risk Management

- Co-ordinate Tax, Trust and Estate , Inheritance & Succession

- Offering Tax-Optimizing Solutions

- Transaction Advisory

- Legal Services

- Administrative Convenience, Accounting & Reporting, Banking & Credit

Corporate Professionals

Are you ready to lead a stress-free life? End to End Management of personal finances, Budgeting & Cashflow management, Risk management & Emergency funding, Asset Allocation, Child Education & Goal Outlay, Tax and Estate outlay, Retirement and Post Retirement outlay, Employee stock options schemes outlay, shareholding & legacy handling.

Business Owners

Establishing credibility with the personal financials, Income & Expenses, Assets &Liabilities, Cash Flow & Budgeting Personal taxes, Insurance & Risk Management, Investing & company employee safeguarding, building pension corpus, succession & inheritance. Employee motivation &retention through the principles of financial planning. Family Office Services.

Second Innings

Do you fancy playing this innings on the front foot? Have you a built a retirement corpus? Is the corpus working for you? inflation hedged need-based income generation, goal-based Asset Allocation outlay, Lifestyle and safety management.

Self Employed Professionals

Establishing credibility with the personal financials, Income & Expenses, Assets &Liabilities, Cash Flow & Budgeting Personal taxes, Insurance & Risk Management, Investing &, Emergency Corpus building, Goal based Asset Allocation Outlay, building pension corpus, succession & inheritance.

NRI

If you are a Non-Resident Indian, wanting to deploy your savings in India in various instruments, we at 3rd EYE Consultants offer consulting services to NRI’s, our expertise helps NRI’s in properly deploying their funds in India in a planned manner which helps them to shape up their Future. Get in touch with us for further details.